Introduction to Commercial Loans

Introduction:

Commercial loans for expanding your Business. Are you ready to take your business to the next level? If so, consider expanding your operations or investing in new equipment.

While this can be an exciting time for any entrepreneur, it often requires significant capital. This is where commercial loans come into play.

Commercial loans provide business owners with the financial resources they need to expand and grow their businesses.

In this blog post, we will explore the world of commercial loans and how they can help you achieve your business expansion goals.

We’ll discuss the types of commercial loans available, how to qualify for them, and the benefits they offer. We’ll also provide tips on choosing the right lender and navigating the application process.

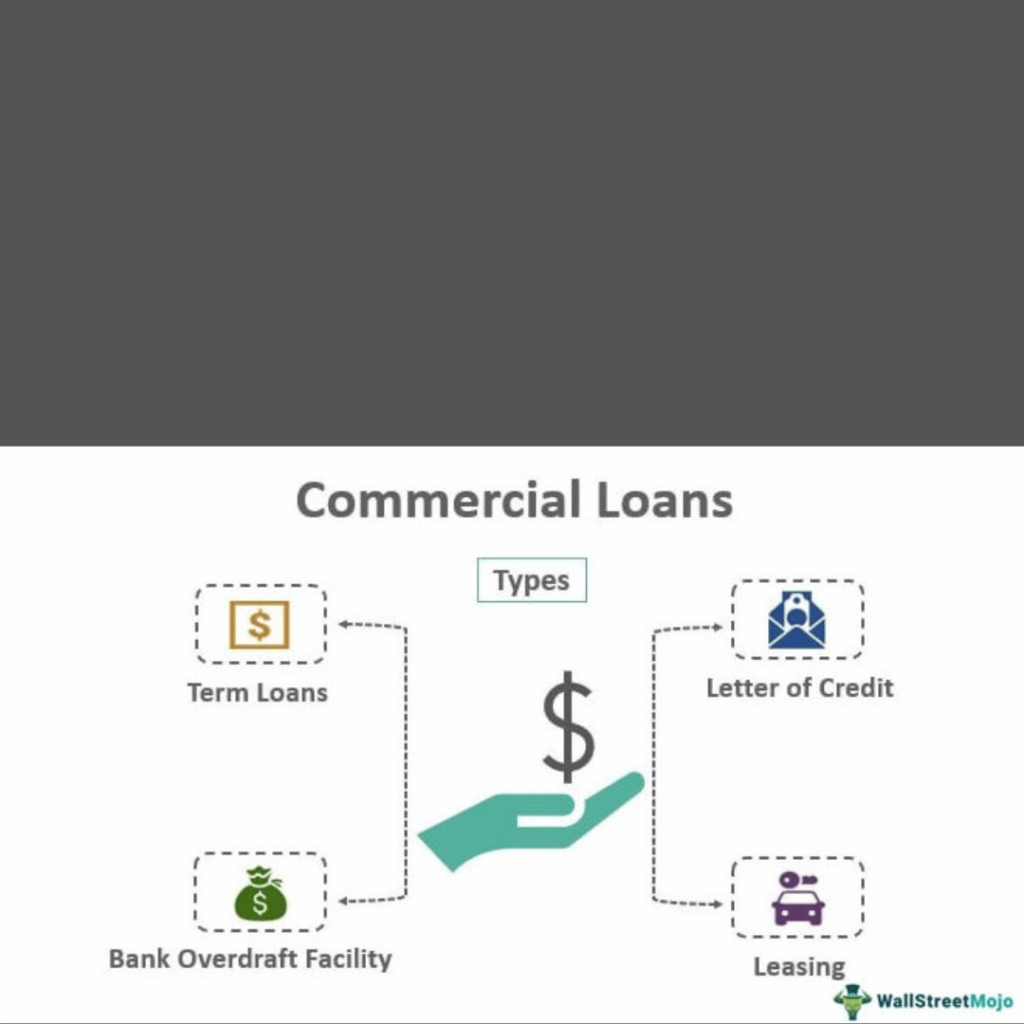

Types of Commercial Loans

Types of Commercial Loans

When it comes to expanding your business, several types of commercial loans are available to help you finance your growth. Understanding the different options can be crucial in finding the right fit for your needs.

One common type of commercial loan is a term loan. This is a straightforward loan where you receive a lump sum upfront and pay it back over a set period with interest. Term loans are typically used for long-term investments such as purchasing equipment or real estate.

Another option is a line of credit, which gives you access to funds whenever needed. With this type of loan, you only pay interest on the amount you use, making it an excellent choice for managing cash flow fluctuations or covering unexpected expenses.

If you want to purchase new inventory or supplies, an inventory financing loan might be the best option for your business. This type of loan allows you to borrow against the value of your existing inventory or future shipments.

Alternatively, if your expansion plans involve acquiring another business or merging with another company, an acquisition loan could provide the necessary funding.

These loans are designed specifically for financing mergers and acquisitions and often come with flexible repayment terms tailored to suit the unique circumstances surrounding these transactions.

If your business operates within specific industries like healthcare or manufacturing, specialized commercial loans that cater to those sectors’ needs may be available.

These industry-specific loans can offer more favorable terms and conditions compared to traditional commercial loans due to their focus on supporting businesses operating in those fields.

Understanding the different types of commercial loans available will enable you to choose one that aligns best with your expansion goals and financial situation. Exploring each option carefully before deciding which suits your specific needs most effectively is essential.

How to Qualify for a Commercial Loan

How to Qualify for a Commercial Loan

Securing financing through a commercial loan can be a game-changer when it comes to expanding your business. But before you start dreaming big and envisioning all the possibilities that come with that extra capital, it’s essential to understand how to qualify for a commercial loan.

Navigating Loan Requirements for New Businesses

Having a solid business plan is crucial. Lenders want to see that you have thought out your expansion strategy and have projected revenue growth. This will demonstrate your ability to repay the loan in the future.

Next, having good credit is essential. Lenders will review your personal and business credit scores to assess your financial responsibility. It’s critical to ensure no errors on these reports and take steps towards improving them if necessary.

Another factor lenders consider is your collateral. They want assurance that they can recoup their investment should something go wrong with the loan repayment. Providing valuable assets as collateral can increase your chances of approval.

Additionally, lenders will evaluate your cash flow and debt-to-income ratio. They want reassurance that you’ll have enough money coming in each month to cover not only operating expenses but also loan payments.

Demonstrating stability in terms of time in business and industry experience can work in your favor when applying for a commercial loan.

Remember, every lender has different requirements, so it’s crucial to research various options thoroughly before choosing one that suits your needs best!

Benefits of Commercial Loans for Expanding Your Business

Commercial loans offer numerous benefits for businesses looking to expand their operations. One of the key advantages is that these loans provide a significant amount of capital, allowing companies to take on larger projects and achieve substantial growth.

With access to additional funds, businesses can invest in new equipment, hire more employees, or even open recent locations.

Another benefit of commercial loans is that they often have lower interest rates than other financing forms, such as credit cards or personal loans.

This means businesses can save money on interest payments over the long term, freeing up more cash flow for other business expenses.

Additionally, commercial loans can be tailored specifically for expanding businesses. Lenders understand growing companies’ unique needs and challenges and may offer flexible repayment terms or longer loan durations. This allows enterprises to manage their debt while focusing on expansion efforts comfortably.

Moreover, obtaining a commercial loan can also help improve a company’s credit profile. By making regular loan payments on time, businesses demonstrate their ability to manage debt and build trust with lenders responsibly. This can lead to better future borrowing terms and strengthen the business’s overall financial position.

Commercial loans provide opportunities for strategic partnerships between lenders and borrowers. Lenders are often invested in the success of their customers’ expansions since it also reflects positively on them.

As a result, borrowers may gain access to funding and valuable industry insights and connections from experienced lenders who want them to succeed.

In conclusion (not used here), commercial loans are an excellent option for expanding your business due to their large capital availability, competitive interest rates, flexibility in repayment terms,

credit-building potential,

and potential added value from lender partnerships.

By leveraging these benefits effectively,

businesses can make significant strides toward achieving their expansion goals

and securing long-term success.

So, if you’re considering taking your business growth ambitions seriously,

consider exploring commercial loan options today!

Tips for Choosing the Right Lender

Tips for Choosing the Right Lender:

1. Research and compare: Research different lenders in your area or online. Look at their interest rates, repayment terms, and customer reviews to understand their reputation.

2. Consider your needs: Consider what you need from a lender – do you want repayment flexibility? Do you need a quick approval process? Make sure the lender can meet your specific business requirements.

3. Ask for recommendations: Reach out to other business owners who have taken commercial loans and ask about their experiences with different lenders. This firsthand knowledge can be invaluable in making an informed decision.

4. Check eligibility criteria: Before applying for a loan, meet the lender’s eligibility criteria. Some lenders may have strict requirements regarding credit scores or years in business.

5. Seek transparency: A suitable lender should be transparent about all fees, charges, and terms associated with the loan. Ensure no hidden costs could catch you off guard later on.

6. Seek personalized service: Look for a lender who takes the time to understand your business goals and tailor their loan offerings accordingly.

A customized approach can make all the difference in finding the right financing solution for expanding your business.

Choosing the right lender is crucial as it will affect your cash flow and long-term financial stability.

The Application Process

The application process for a commercial loan is an essential step in securing the funding you need to expand your business.

To start, you will typically need to gather and prepare all the documentation lenders require. This may include financial statements, tax returns, and business plans.

Once you have all your documents ready, it’s time to submit your application. You can do this online or in person at a bank or financial institution.

Be prepared to provide detailed information about your business, such as its history, current operations, and future growth plans.

After submitting your application, the lender will review it carefully. They will assess factors such as your credit score, collateral (if any), and cash flow projections.

The length of time it takes for them to make a decision can vary depending on the complexity of your request.

If approved for a commercial loan, you will receive an offer outlining the terms and conditions of the loan. Take the time to review these thoroughly before accepting or negotiating any changes.

Once you accept the loan offer, it’s time to finalize all necessary paperwork and complete any additional requirements from the lender. This may include providing insurance coverage or legal documentation.

While applying for a commercial loan may seem like a daunting process initially, with proper preparation and attention to detail throughout each step of the way – success could be just around the corner!

Common Mistakes to Avoid When Applying for a Commercial Loan

When it comes to applying for a commercial loan, there are several common mistakes that business owners should avoid.

These mistakes can delay the approval process and hinder your chances of securing the necessary funds for expanding your business.

One common mistake is failing to research and compare lenders thoroughly. Shopping around and finding a lender that offers competitive interest rates, flexible repayment terms, and excellent customer service is essential. Taking the time to do this research upfront can save you from potential headaches.

Another mistake is needing a clear plan for using the funds from the commercial loan. Lenders want to see that you have a solid strategy for using their money wisely and generating enough revenue to repay the loan. A detailed business plan outlining your expansion goals and financial projections will significantly increase your chances of loan approval.

Additionally, many businesses need to apply for more funding. Using for an amount that exceeds what you need can raise red flags with lenders while asking for too little may leave you short on cash when it comes time to execute your expansion plans. Be sure to carefully assess your financial needs before submitting your application.

Another common mistake is neglecting to review all documents and terms associated with the commercial loan agreement.

It’s crucial to read through every contract detail before signing anything. This includes understanding interest rates, repayment schedules, penalties for late or early repayment, and any additional fees or charges.

By avoiding these common mistakes when applying for a commercial loan, you’ll be setting yourself up for success in expanding your business without unnecessary setbacks or complications.

Case Study: Successful Business Expansion with the Help of a Commercial Loan

Case Study: Successful Business Expansion with the Help of a Commercial Loan

One shining example of how a commercial loan can fuel business growth is the story of XYZ Manufacturing, a small-scale furniture company based in California.

The owners, John and Sarah Thompson, had been running their business for several years and were eager to expand into new markets.

With limited funds, they decided to explore obtaining a commercial loan. After careful research and consideration, they approached ABC Bank for financing assistance.

The bank was impressed by XYZ Manufacturing’s track record and growth potential, making it eligible for a substantial loan amount.

With the commercial loan’s financial boost, XYZ Manufacturing began implementing its expansion plans. They invested in state-of-the-art machinery to increase production capacity and improve product quality. They also hired additional staff members to meet growing demand.

As expected, these strategic moves paid off handsomely for XYZ Manufacturing. Their enhanced capabilities allowed them to secure domestic and international contracts with major retailers.

With increased revenue streams pouring in, they could repay the commercial loan quickly while maintaining healthy profit margins.

The success story of XYZ Manufacturing underscores how a well-managed commercial loan can catalyze business expansion.

It enabled them to overcome financial limitations holding back their growth potential while positioning themselves as industry leaders.

This case study exemplifies the transformative power of commercial loans when used wisely by businesses looking to expand.

By carefully assessing opportunities and choosing reputable lenders such as ABC Bank, offering competitive terms and interest rates along with diligent planning and execution strategies like those implemented by XYZ Manufacturing – entrepreneurs can turn their dreams into reality!

Conclusion

Conclusion

Expanding your business can be an exciting and rewarding endeavor, but it often requires significant capital. Commercial loans provide the financial support needed to advance your business.

Whether you want to purchase real estate, invest in equipment or inventory, or hire additional staff, commercial loans can help make your expansion dreams a reality.

By understanding the different types of commercial loans available and ensuring that you meet the necessary qualifications, you can position yourself for success. Finding the right lender for your specific needs is also crucial, as this will impact your loan’s terms and interest rates.

When applying for a commercial loan, it’s important to carefully navigate the application process by providing all required documentation and information accurately and promptly.

Avoiding common mistakes such as incomplete applications or inadequate financial projections will increase your chances of approval.

A well-executed case study illustrates how a successful business utilized a commercial loan to expand its operations effectively.

Readers gain valuable insight into what is possible when leveraging these financing options by highlighting their experience from start to finish – planning their goals, securing funding through a trusted lender, and implementing strategic changes within their organization.

In conclusion (without using “in conclusion”), commercial loans offer entrepreneurs an opportunity for growth by providing them with much-needed capital for expanding their businesses.

With careful research and planning, coupled with intelligent decision-making throughout the lending process,

entrepreneurs can confidently pursue their expansion goals knowing they have secured vital resources.

So, if you’re ready to take that next big step toward growing your business,

consider exploring commercial loan options today!